Even without a blockbuster like 2024’s Black Myth: Wukong, China’s gaming market continued to grow robustly in the past year, fueled by exciting new titles and a more stable regulatory environment

Looking at the Chinese gaming scene in 2025, it’s impossible not to feel the lasting impact of 2024, a landmark year for the industry. The Journey to the West-inspired action game Black Myth: Wukong, China’s first blockbuster AAA game, sold nearly 30 million copies, proving that premium, single-player experiences can succeed alongside mobile-first free-to-play titles, a model that had been favored by risk-averse Chinese developers.

Building on the success of 2024, China’s gaming sector continued its robust growth, with long-term annual growth of 7 percent since 2019. China’s domestic gaming market generated approximately 351 billion yuan in actual sales revenue, with a player base of around 680 million. Tencent and NetEase also make it into the top five highest-grossing gaming companies worldwide.

The outlook has also improved thanks to a more stable regulatory environment, after restrictions on youth playtime and in-game monetization had previously weighed on the industry. Game approvals hit a seven-year high in 2025, with over 1,700 titles cleared—a 25 percent increase from the previous year—appearing to put the license freezes of 2018 and 2021 behind the industry.

China also continues to cement its place as an esports powerhouse, breaking the world record for attendance in November 2025 at the Honor of Kings Professional League (KPL) Grand Finals, with over 62,000 spectators packing the famed Beijing National Stadium, also known as the Bird’s Nest.

Naturally, AI has become a major area of investment as companies experiment with the rapidly advancing technology in their development pipelines. Tencent is leading the way with its 3D creation platform, Hunyuan 3D, while its VISVISE toolkit—an end-to-end AI game creation suite—is already being adopted by creators.

While no release could rival the success of Black Myth—which announced a sequel, Black Myth: Zhong Kui—there were still notable highlights this past year.

Escape from Duckov, a cute animal-based parody on the gritty Russian shooter Escape from Tarkov, was the surprise hit, produced by a five-person studio, Team Soda (internal to streaming giant Bilibili). The game has become the most successful title the streaming platform has launched since entering the gaming development space, selling more than 3 million copies within the first month. Its brilliance lies in somehow translating the serious, multiplayer, first-person experience of Tarkov into a fun, single-player, top-down format while retaining a similar flow.

Other titles found a warm reception within their niches, reflecting the industry’s growing diversity and creative vitality. Pollard Studio’s 1984-inspired psychological thriller Karma: The Dark World had a low-key March release at a budget price of 25 US dollars and has since built a word-of-mouth following for its layered storytelling and production values. It joins the sparse literary beauty of Hymer 2000, inspired by Nobel Prize-winning novelist Kazuo Ishiguro’s Never Let Me Go, and the truly bonkers, startlingly original psychological card game Out of Hands as one of 2025’s hidden gems.

Some games have even managed to break containment over to non-gamers. The dark horse of the year, Sultan’s Game, unexpectedly went viral on the social media platform Xiaohongshu (RedNote), racking up over 590 million views by July 2025 for its One Thousand and One Nights–inspired, story-rich gameplay of harrowing choices dictated by cards. It has sold over 1 million copies and received overwhelmingly positive reviews—scoring 83 on Metacritic and 94 percent positive on Steam—and eventually took home the Grand Prize at the 2025 INDIE Live Expo Awards.

Sultan’s Game casts players as a servant to the sultan, who must draw a “sultan card” every seven days and complete its assigned challenge—or face execution. Card types include “Lust,” “Luxury,” “Conquest,” and “Slaughter,” each representing a different moral dilemma and life-or-death trial. (Steam)

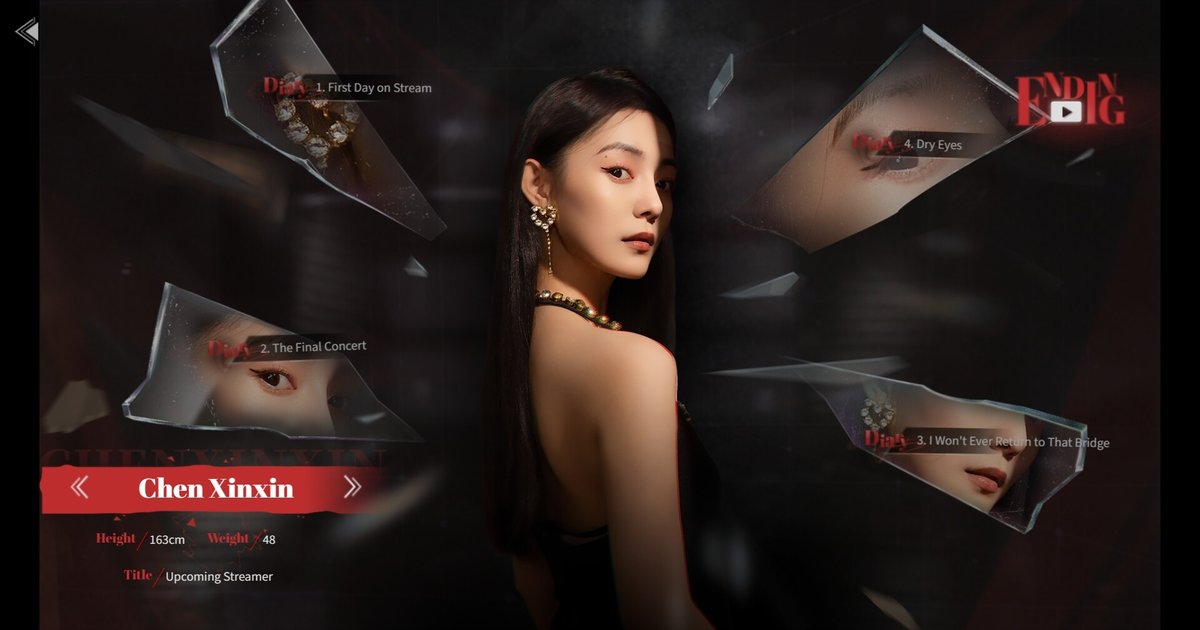

Then there’s Road to Empress, an interactive film charting a lowly consort on the rise to becoming Empress Wu Zetian. It found broad appeal through its accessible, choice-driven play style, allowing fans to vote on their most cherished and despised characters. Novel features and meme-worthy moments helped boost its viral recognition. The same goes for the College Student Mountain-Climbing Disappearance Case (also known as Big Mountain), a free internet-browser ARG (alternative reality game) largely crafted by a non-coder with the help of AI. ARGs tell stories through fake websites, social media accounts, photos, and other real-world elements to create an immersive mystery. Usually a niche genre, Big Mountain was new enough for Chinese players and simple enough to spark passionate online sleuthing. It highlights the potential of AI while preserving a crucial human touch.

Meanwhile, the epic historical and mythological action-game space, pioneered by Black Myth, remained vibrant. Wuchang: Fallen Feathers, the female-pirate-led, late Ming dynasty (1368 – 1644) action RPG, sold over 2 million copies and received mostly positive reviews, scoring 75 on Metacritic, despite a rocky launch. NetEase’s Where Winds Meet, set in the Five Dynasties and Ten Kingdoms period (907 – 979), attempted to straddle free-to-play and premium single-player design. Its efforts drew over 15 million players in the first month, earning a spot among Steam’s top 10 most-played games, with audiences willing to overlook the rougher mechanics and sprawling, kitchen-sink gameplay.

The year has also seen notable flops and controversies. In July, Sony sued Tencent over its upcoming Light of Motiram, claiming it bore an uncanny resemblance to Horizon Zero Dawn. The companies reached a confidential settlement in December, and the game vanished from digital storefronts.

Also in July, the interactive-film game (FMV) Revenge on Gold Diggers became a flashpoint for different reasons. Since 2023’s Love Is All Around, there has been a craze for Chinese FMV dating sims aimed largely at men. Revenge’s Chinese title was initially translated literally as “Game of the Gold Diggers,” but was soon changed to “Romance Scam Simulator” following severe backlash. Much of the controversy stems from references to Pangmao, a game booster who died by suicide in 2024. His girlfriend was initially labeled a gold digger online, but police found no wrongdoing and revealed that Pangmao’s family had selectively leaked information to frame this narrative for financial gain. The case was highly publicized at the time and sparked heated debates about gender and online defamation. Revenge, uncoincidentally, follows a man’s quest for vengeance after falling victim to a romance scam. Supporters say it raises awareness, while detractors argue it reinforces regressive stereotypes. Nevertheless, the game is a commercial success, topping Steam charts and selling around 1 million copies in the first month.

Many have pointed out that Revenge on Gold Diggers feels more like a collection of micro-dramas, strictly following the pacing of short-form storytelling and delivering a plot twist every few minutes (Steam)

But some games just failed to live up to lofty expectations. Lost Soul Aside began as a solo project in 2014 before being picked up by Sony for phase one of its China Hero Project, a mentoring and support initiative for China-based developers launched in 2016 after China lifted its console ban. As a Black Myth-style premium-priced single-player experience, Lost finally launched in August 2025 to bad reviews and poor sales, hampered by a lack of polish, a throwaway story, and a perception gap between its modest budget and AAA expectations. Meanwhile, the third-person online mech shooter Mecha BREAK went all-out with a documentary series in partnership with IGN, but soon lost about 75 percent of its player base after some monetization practices were criticized, and the game failed to gain lasting traction.

Global interest in Chinese games is at an all-time high, reflecting the growing reach of the country’s cultural soft power, and eyes are already on the horizon. A wave of new titles is coming in 2026 and beyond, including AAA releases like Phantom Blade Zero and Swords of Legends, as well as strong offerings from top indie publishers like Gamirror Games and GCORES. Keep an eye out for Fools, Maniacs and Lairs and Roots Devour—and most of all, happy gaming in the year to come.