A collective lunacy about the future of commuting may have finally ground to a halt

Did a sense of collective lunacy afflict financial media and markets for the last two years? Call it the shared-bike dream.

In this popular fantasy, dock-less bicycles had never previously existed, and cities were desperate to be flooded with them. Big Tech had the answers: There would be a series of apps, as many as 60 or 70, all backed by mass-industrial output and cold, hard venture capital, which would finally fix the so-called “last mile” problem.

Cheap, efficient, and convenient, shared bicycles would also reduce urban pollution, ease traffic jams, and bring relief to a much-strained public transport system. The smaller app promised investors the hope of being bought out by a larger one looking to swallow competition. The major players, like Mobike and ofo, would focus on long-term dominance—by waging price wars a la Uber, surging sidewalks with their signature liveries, and hoping overcapacity could conquer economic gravity as it had seemed to have done so before.

This created vast inconvenience and delays for commuters, with bike-shares blocking roads and sidewalk, treating the city like their personal playground—something no mere sidewalk snack-slinger, busker or beggar could ever hope to get away with—and somewhat defeating the point of the dream.

So the pedestrians fought back. Bikes were trashed, pinched, and discarded in often remarkably convoluted ways; it takes stamina and skill to throw a Mobike up a tree, as some artists recognized. Bikes vanished as fast as they could pile-up (Beijing had 2.3 million at one point); in Chongqing, the startup Wukong had a loss rate of 90 percent.

Amid the spate of thefts and vandalism, there was hot air about “soul searching,” as if the treatment meted upon these cheap jalopies was some local condition of the psyche, rather than a predictable response to what was now a vicious turf war between six or so remaining rivals, fought on public spaces that were already shrunken, chaotic, and physically neglected.

The lawsuits soon mounted, including one from a grieving family who (probably unfairly) blamed ofo for their son’s death—the 12-year-old had stolen one of their bikes and ridden it into a bus. Local governments followed suit; Mobike sued for slander. Ofo retreated from foreign markets, as Mobike expanded.

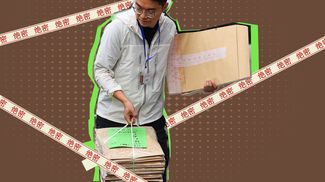

But even as the heady summer of 2017 grew to a close, state media acclaimed bike sharing as one of “four great inventions of modern China.” Over a year later, though, this dream seems largely dead. Bluegogo was the first major participant to fold, though partly acquired by Didi, leaving 70,000 damaged bikes in one Beijing “bike graveyard” as well as furor over lost deposits; its CEO admitted to having been “filled with arrogance.”

Ofo has a mounting pile of debts, including 26 million HKD to partners in Hong Kong, and has withdrawn from most of the territories it once boasted about conquering. In the last year alone, it has been hit with nine new lawsuits. Former employees have duly spilled beans, with Huxiu reporting familiar tech tales of squandered cash, corruption, and frenzied office politics, followed by mass layoffs.

While companies like Hellobike are still talking big, Mobike, acquired by Meituan in April, continues to lose active losers (analysts have since questioned even this data, finding a continuous pattern of inflated figures). The upstart entrepreneurs who once dismissed talk of profit with warlike spiel about self-discipline, focus and zero-sum results, are now having to answer tough questions from wary investors. The companies’ core business model is full of holes.

One secret weapon was said to be data collection, particularly revealing urban movement (commuter journeys, traffic patterns)—information that, as The New York Times recently revealed, is being already sucked up and sold by just about every other app, so this hardly seems proprietary information, though certainly invasive.

Deposits, another key plank in the plan, have been lost or vanished. Mobike no longer requires them but, for some, retrieval can be a long march to nowhere: one company, the formerly Beijing-based Coolqi, offered a series of phone numbers or an address in Chengdu for people trying to reclaim theirs.

This November, in a bid for understatement of the year Mobike’s Meituan announced plans to downsize to “avoid an oversupply.” Winter has arrived, and it may be a long one.