Could a Maoist marque help steer China’s automotive revolution?

As a young executive in China’s financial sector, Mr. Wang is no stranger to luxury cars. But one evening, flipping through video-sharing app Douyin, he stopped in surprise at images of a sleek, black concept car, with a red line cutting across its massive fan-like grille. “I couldn’t believe it!” Wang exclaimed. “It was a Hongqi.”

The story of Hongqi (“Red Flag”), a car once conceived as China’s answer to Cadillac, has become symbolic of the nation’s own automotive industry. From the gas-guzzling relics of the 1970s to today’s cutting-edge driverless vehicles, there has, perhaps, been no Chinese industry more utterly transformed since Deng Xiaoping began his reform and opening-up policy in 1978.

In the process, though, the auto industry has become arguably one of China’s most controversial. Today, it is both a continued source of friction in the US-China trade war, and a model for other countries looking to protect their nascent domestic industries and climb up the ladder of value-added manufacturing.

Among China’s many homespun auto brands, Hongqi is certainly the oldest and, for many, the best known. Manufacturing was reportedly jumpstarted after an offhand comment by Mao Zedong, expressing his disappointment with being chauffeured in a Soviet-made sedan. When the original Hongqi came off the First Automotive Works assembly line in 1958, the result was a product of zero automation; based on an old Chrysler V8 design, the CA770 was completely handmade.

Over subsequent decades, Hongqi’s CA770 cemented itself as a symbol of power, becoming the go-to vehicle for ferrying politicos and visiting dignitaries, although only 847 were ever built (most are now museum or collector’s items). This exclusivity ensured that, even today, the most iconic Hongqi image is that of top leaders being driven while standing in a classic black sedan, inspecting People’s Liberation Army troops during military parades. Hongqi is now the standard transport provided for most foreign leaders visiting Beijing, leading to a proliferation of the auspicious autos on Beijing’s roads during events like the 2017 Belt and Road Summit and the 2018 Forum on China-Africa Cooperation.

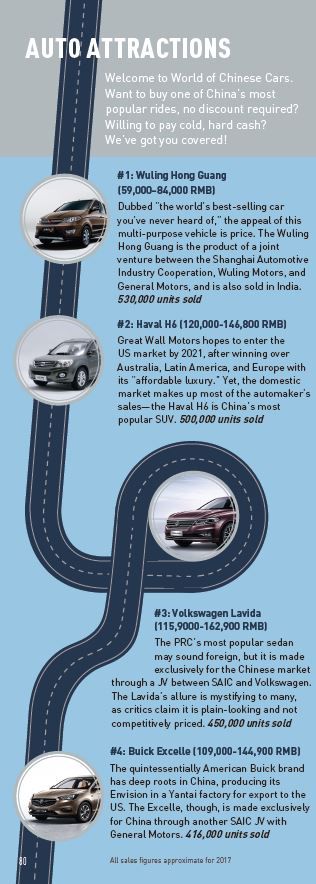

However, the brand almost died out in the early years of reform. In 1981, production was halted, as China embarked on a new strategy of Joint Ventures (JVs). Foreign brands were only provided with market access if they opened a China-based JV with an established domestic automaker. In 1984, Shanghai Automotive Industry Corporation paved the way with a partnership with Volkswagen, and other companies quickly jumped on board. Hongqi’s parent company, China FAW Group Corp (FAW), developed JVs with Audi, Volkswagen, General Motors, and Toyota.

According to Xing Lei, the chief editor of China Automotive Review, the JV structure provided an optimal environment for Chinese companies to gain vital know-how: “Chinese companies were able to learn industry standards in the management process, corporate organizational structure, manufacturing, R&D, sales, aftersales, and virtually every link of the manufacturing chain imaginable,” he tells TWOC. “In return, they offered their foreign partners knowledge about local consumers and how to do business in China.”

However, the JV rule also “turned out to be a double-edged sword. While the rule protected Chinese partners from foreign competition, many companies grew reliant on their foreign partners for profit, hindering innovation and independent brand development.”

While Mercedes and Audi became the cars of choice for many top-level officials during the 1980s and 1990s, the government’s “Made in China 2025” policy, which aims to revitalize Chinese brands and reclaim market share from foreign companies, has breathed new life into Hongqi at the same time it raised red flags for many foreign brands.

In 2013, FAW poured over 300 million USD into a “Red Flag Revival Project,” and by 2014, regulators had launched a series of anti-trust investigations into Audi and other foreign car companies. Later that year, the PLA announced that they would only purchase domestic car brands and purchased 1,000 exclusive 2.5-liter H7s. In 2016, China hiked a 10-percent import tax on “super luxury” vehicles—autos priced over 1.3 million RMB—impacting much of Hongqi’s foreign competition.

Despite the investment, procurement orders, and import taxes, conditions were still not enough to endear Hongqi’s range of H7s to Chinese consumers. In fact, the company only sold 3,000 cars in 2014, even though it had the capacity to produce three times that amount. In 2016, FAW announced it had lost 127 million USD on Hongqi.

The brand’s dismal sales performance was frequently attributed to the tastes of wealthy consumers, who prefer to purchase imports to flaunt their wealth, rather than Mao’s old-school sedan.

In response, Hongqi wheeled out its L7 and L5 luxury limousines at that year’s Shanghai and Beijing Motor Show, respectively. Billed as “China’s most expensive car,” the L5 is priced at a cool 800,000 USD, and described by Top Gear as resembling a “modern Phantom that crashed head first through the 1950s.” The 18-foot, four-wheel-drive was aimed at the patriotic billionaire prepared to pay a lot (a Lamborghini Aventador Roadster equivalent comes in at only 600,000 USD) and perhaps wait even longer. While the government debuted the limousine for then-French President François Hollande in 2013, the availability of the civilian edition is shrouded in some mystery; even when a limited run of 100 L5s was announced in early 2018, the exact costs, and other specifics, were left vague.

Meanwhile, reviews for the standard sedan have been lukewarm: Autocar praised the H7’s “equipment levels, spacious rear and the design cues which speak of Hongqi’s heritage,” and concluded “the car is a good effort, but is ultimately confused…the cheap materials and lack of customization let the side down.”

Xing points to the success of Chinese phone-makers like Xiaomi and Huawei, whose products faced similar criticism, but ultimately won over consumers by combining competent design and functionality with an attractive price point—something Hongqi still lacks. “The new generation of Chinese has different tastes,” Xing argues. “They are increasingly accepting Chinese brands as new status symbols.”

Leading the charge to raise the Red Flag yet again is an ambitious new chairman, Xu Liuping. “Hongqi is finally on the right path, but it still will face some resistance,” proffers Xing. “The brand is repositioning itself with a focus on design, having recently hired the former design director of Rolls-Royce.” Baidu, China’s equivalent to Google, has confidently announced plans in 2020 for a limited edition of self-driving Hongqi vehicles that are expected to be fully autonomous in most driving conditions, according to Baidu CEO Robin Li and FAW’s Xu.

Sales are also finally on an upward trend: In the first 11 months of 2018, they surged to 24,800 vehicles.

However, it seems like decades of implicit protection for China’s auto industry may also be numbered. US President Donald Trump tweeted in December 2018 that he expected China to reduce the 40 percent tax on imported American cars to 15 percent. So far, many US brands have avoided tariffs by producing within China, with Ford and Buick making models exclusively for the Chinese market; indeed, the Buick Envision and the Cadillac CT-6 hybrid are actually exported to the US.

However, Xing believes that the industry is at a point in its development where it can withstand increased competition. “I expect China to become a large exporter of automobiles as Chinese brands become global,” he predicts. “Foreign brands are also likely to start utilizing the breakthrough technologies Chinese companies have made in new energy vehicles.”

While China’s auto industry will doubtlessly survive, it is yet to be seen if Hongqi will help lead the charge, or if it has bitten off more than it can chew. The marque has a new range of electrical vehicles, which landed an enviable spot in the opening hall of the National Museum of China’s temporary “40 Years of Opening Up” exhibition. It has designed a new H5 model in the 150-200,000 RMB range to appeal to China’s middle class, and it continues to be the vehicle of choice for businessmen trying to cultivate their populist public image.

This year, Cao Dewang, the charismatic chairman of Fuyao Glass Industry Group, purchased a custom-made L5 limousine to the tune of 6 million RMB. The reason? As Cao told China Daily, he wanted to “contribute to the development of the national auto industry.”

Raise the Red Flag is a story from our issue, “Home Bound.” To read the entire issue, become a subscriber and receive the full magazine.